Are you feeling the squeeze lately?

Joe and I have been more stressed than usual this past year or so with increases in taxes, healthcare costs, and everything just costing more. It feels like everyone’s hands are in our pockets!! Then of course our kids keep growing. Have you heard the rumors about teen boys and how much they eat? They’re all true!

Joe does a fabulous job managing our big picture and keeping the details organized. He’s amazing. And we’ve been super deliberate over the years to always spend less than we make and stay out of debt. And we didn’t worry as much about the extra coffee or video rental when we had some margin of error.

But lately as that margin is shrinking, we knew we had to look more closely at our discretionary spending. Work more intentionally as a team to keep the budget balanced. It wasn’t just spending less- but we had to totally up our game with communication. And literally be on the same page when planning our budget.

Enter, the Book.

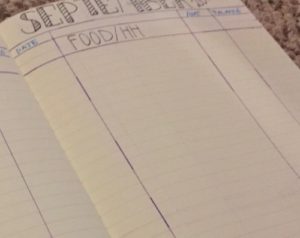

Our solution was to get a book and be more diligent about tracking our spending. Have a physical place where we can each see how the numbers are adding up. Just mentioning stuff to each other wasn’t going to cut it. I already use the Leuchtturm1917 Hardcover Notebok for my bullet journal, so we bought another one specifically for finances. I love paper books!! Originally we looked into buying something pre-made but couldn’t find anything that would work for what we needed . So we just drew in our own columns and headings, and wha-la! We call it the Ledger. Everything goes in the Ledger. Every check and every swipe of the credit card gets written down.

The point of the book was for day to day stuff we lose track of. Especially the $10 here, $20 there that sneak in! It doesn’t include payments that are made “off the top” such as mortgage, taxes, giving, savings. By managing all those discretionary expenses more carefully we’re hoping to better meet our future goals. Gotta keep the big picture in sight!

A Bit of How-To:

Setting up your own ledger isn’t hard at all. For each month, list a category for each page or section, whatever is relevant for your household. Ours are Food/Household, Auto, Utilities, Misc. Those are the ones for us that vary the most in a month. At the top of each category write your budget for the month. Have a column for date, item, amount, and balance. Every time you have an expense, note it in the proper page, note the date and amount and calculate the balance. As the month goes on, you can see how much has been spent. Then most importantly, talk to your spouse- either before a purchase is made or soon after. Keep those lines of communication open!

And, a few months later

And, a few months later

We’re on our third month of using the Ledger!! Although it can be time-consuming looking at our numbers every couple days, it has actually become a huge gift. Know what the secret was? Using it! And when we made budget in every category last month it totally motivated us to stay the course!

There are two more important features we added to our Ledger: I’ll tell you about those in Part 2!

Leave a Reply